3 Ways to Download Pan Card - Get Instant e-PAN PDF Online 2025

A PAN Card (Permanent Account Number) is a unique 10-digit alphanumeric ID issued by the Income Tax Department of India for financial and tax-related identification.

PAN card available in two format like one is a physical card and another one is a pdf format, which is known as e-PAN card. This e-PAN is equivalent valid at every place compare to physical pan card. You can download PAN card quickly with nominal fees.

Today, I will share 3 methods (Free and Paid) by using them you can easily download your PAN card as a pdf within 5 minutes.

Difference between PAN card and e-PAN card?

Before going deep to download e-PAN card, you must know about the difference between them.

Let's see, an e-PAN is a digitally signed pdf document which is issued by IT department of India. While the normal PAN card is a physical card. You can check the below table for detailed information

| Feature | PAN Card | e-PAN Card |

|---|---|---|

| Format | Physical laminated card | Digital PDF format |

| Issued By | Income Tax Department of India | Income Tax Department of India |

| Delivery | Sent via postal service | Sent via email |

| Application Mode | Online & Offline | Online only |

| Processing Time | Takes a few days to weeks | Instant issuance (within minutes) |

| Validity | Lifetime | Lifetime (same as physical PAN) |

| Use Case | Required for official document submissions where physical PAN is needed | Useful for quick verification and digital transactions |

Methods to Download e-PAN Online (Free & Paid)

There are basically 3 methods to download e-PAN means you have to visit three different central govt official portal. Check their name below.

- NSDL PAN Card Download

- UTIITSL PAN Card Download

- Income Tax e-Filing Portal

Steps to Download e-PAN Card from NSDL (https://www.proteantech.in/)

Anyone those who applied for PAN card on the NSDL (National Securities Depository Limited) Portal can download their e-PAN from the portal easily. Let's deep dive into the steps which you have to follow.

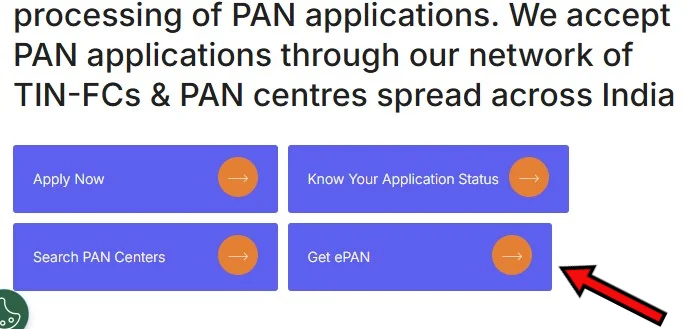

- Step 1: First of all visit the Official Website of NSDL Portal; https://www.proteantech.in/services/pan/

- Step 2: Scroll down on the home page, and click on the "Get ePAN" option under the "Protean’s Tax Services".

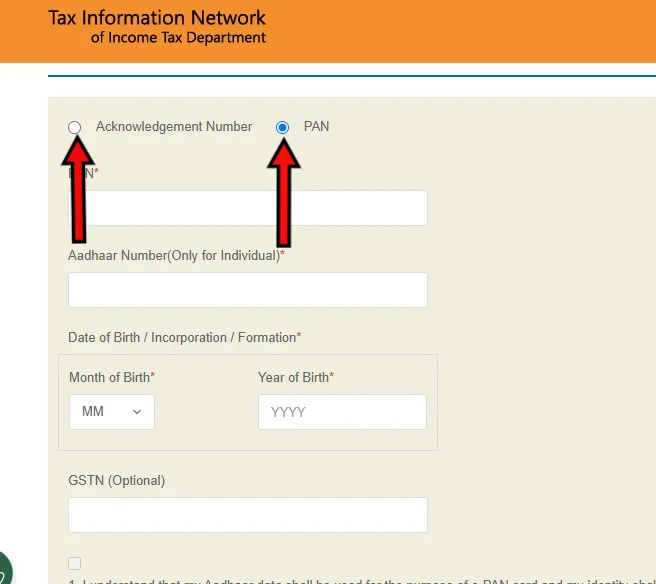

- Step 3: Now you will be redirected to the new page where you have primarily two options.

- Acknowledgement Number

- PAN Number

- Step 4: After that, you have to enter your Date of Birth, Aadhaar number if you selected PAN option and Captcha.

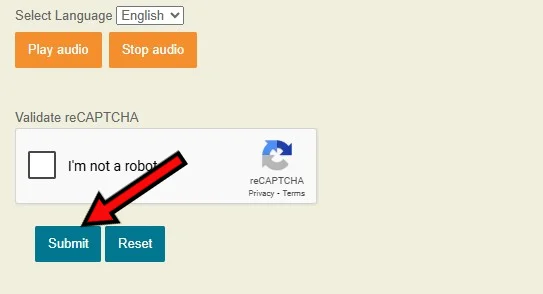

- Step 5: Now hit the Submit button, and then verify your OTP which is sent to the registered mobile number or email id.

- Step 6: After that, you have make payment of Rs 8.26 (including tax) through net banking or credit/debit card.

- Step 7: Once payment succeed, you can download your ePAN as a PDF format and also sent to your email id.

Note: If you have a PAN number, then you can select the PAN option otherwise if you don't have PAN and download the first time then select acknowledgement number option.

Note: PAN card application fee will be charged only, if you download the PAN more than 3 times from the issuance within 30 days.

e-PAN Card Download through UTIITSL Portal

All the citizens has this second option to download PAN card which is from UTIITSL (UTI Infrastructure Technology and Services Limited). Let's check the steps which you have to follow for the ePAN PDF.

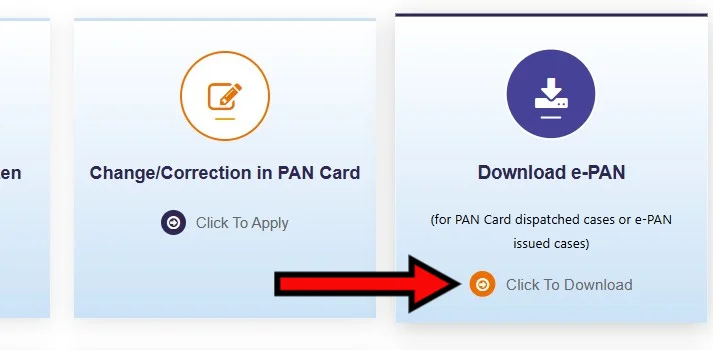

- Step 1: Visit the official portal of UTIITSL in your browser; https://www.pan.utiitsl.com/

- Step 2: Scroll and click on the "Download ePAN" option on the home page.

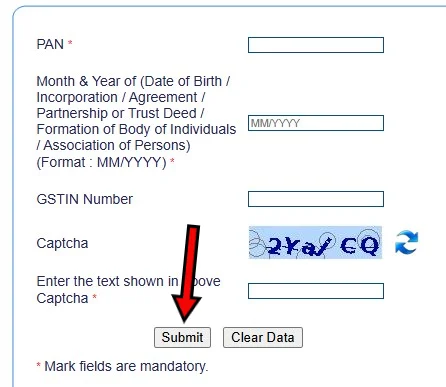

- Step 3: Now you will be redirected to the new page, where you have to provide the details like PAN number, DOB and Captcha code.

- Step 4: Once entered the details, click on Submit button.

- Step 5: Now you have to verify the OTP which will sent to your registered mobile number or email id.

- Step 6: Next, you have to pay a nominal fees of Rs. 8.26 if you download the e-PAN after the 30 days of issuance.

- Step 7: After successfull payment, you can download PAN card through UTIITSL portal.

Download e-PAN Card through Income Tax e-Filling Portal (Free)

If you want to get an instant e-PAN, the Income Tax e-Filing Portal is the best option for you. Let's check the steps below.

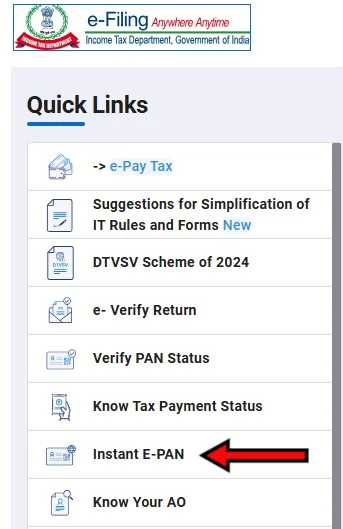

- Step 1: Open the Official Website; https://www.incometax.gov.in

- Step 2: Navigate the "Instant e-PAN" option under the "Quick Links" section on the home page.

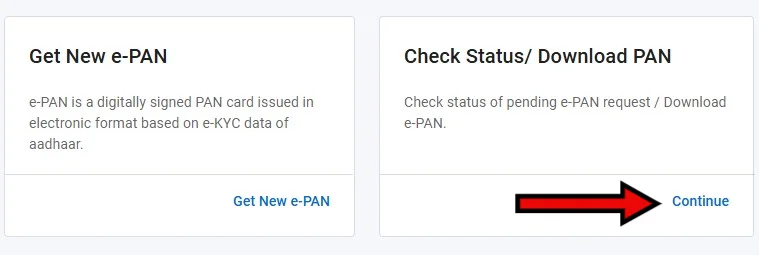

- Step 3: Next, you have two options from which you have to select "Check Status/ Download PAN" and click on the "Continue".

- Step 4: On the next page, you have to enter your Aadhaar number and verify OTP.

- Step 5: Once verified, you can download your e-PAN in PDF file without paying any money (FREE).

Attention: As per Section 139A of the Income Tax Act, 1961, you are not allowed to have more than one PAN card. If you hold multiple PANs, you could face a penalty of ₹10,000 under Section 272B(1). Make sure to use only one PAN to avoid any legal issues.

What is the Password of e-PAN PDF?

When you downloaded your ePAN PDF then it will be password protected by default. So, the password of the PAN Card pdf file is your Date of Birth. Check the below examples for clarity.

- Example 01: If applicant's date of birth is 28th March, 2002 than the password is 28032002.

- Example 02: If applicant's DOB is 6th June, 1995 than the password is 06061995.

This type of password protected file helps to secure your personal information.

Contact Details

Still you are facing any problem regarding PAN Card download then you can directly contact to the helpline number or email below to the regarding portal.

| Portal Name | Email ID | Helpline Number | Timings |

|---|---|---|---|

| NSDL | N/A | (020) 272 18080 | 07:00 AM to 11:00 PM (All Days) |

| UTIITSL | utiitsl.gsd@utiitsl.com | +91 33408 02999, 033 40802999 | 09:00 AM to 08:00 PM (All Days) |

The Bottom Line

Friends, here we provide full details on how to download your pan card online as a PDF. You can follow any method and easily download your ePAN without need of any third person. If you found this article helpful then please share it with your friends.

Still you suffering any doubt about PAN Card download than please feel free to ask us directly through contact us page. We will try to solve your queries as soon as possible.

Frequently Asked Questions (FAQs)

What is the difference between PAN card and e-PAN card?

A physical PAN card is a printed laminated card delivered to your address, while an e-PAN card is a digitally signed PDF copy available online.

Is e-PAN valid like a physical PAN card?

Yes, an e-PAN is equally valid as a physical PAN card for identity verification and tax purposes.

How can I download my e-PAN card?

You can download your e-PAN card from the Income Tax Department’s website or NSDL portal using your PAN number and date of birth.

What happens if I have two PAN cards?

Holding multiple PAN cards is illegal. You may face a penalty of ₹10,000 under Section 272B of the Income Tax Act, 1961.